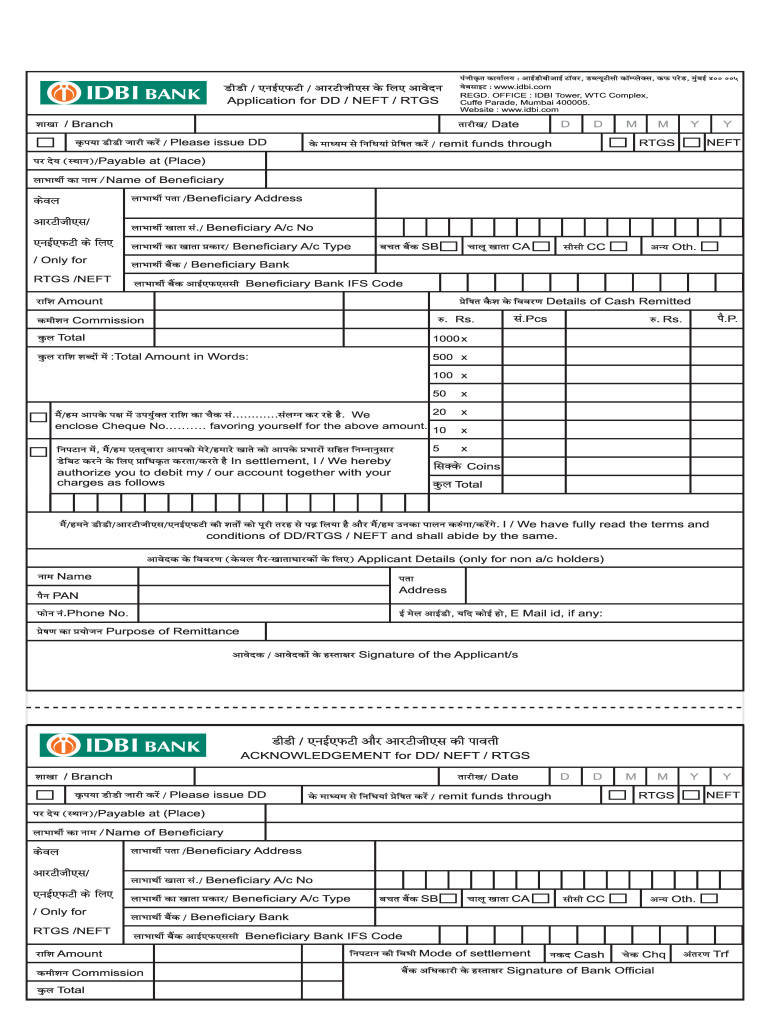

India IDBI Bank Application for DDNEFTRTGS free printable template

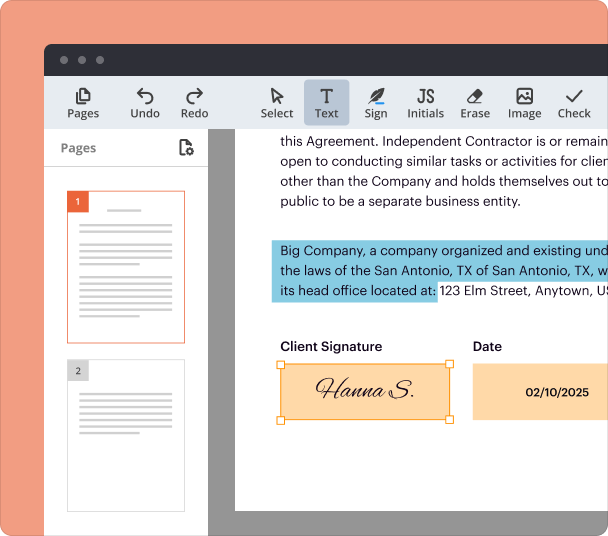

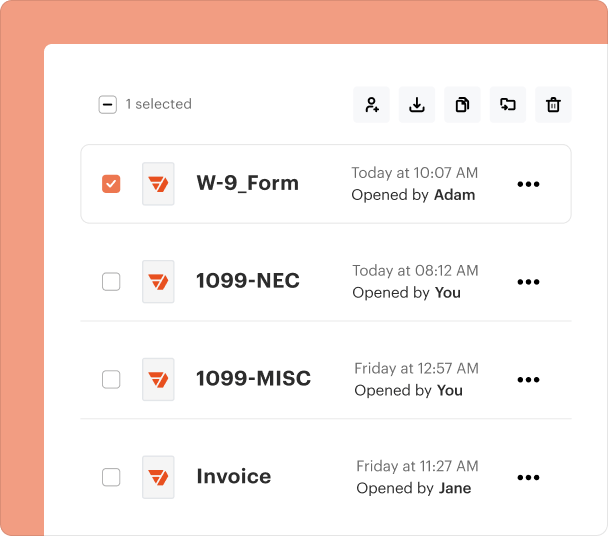

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

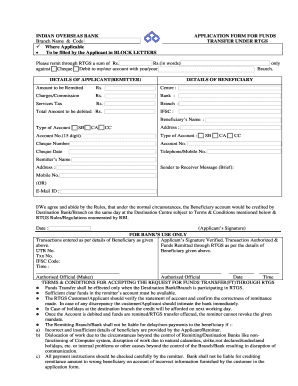

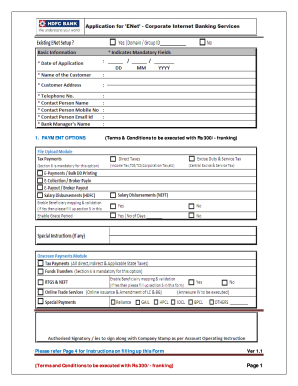

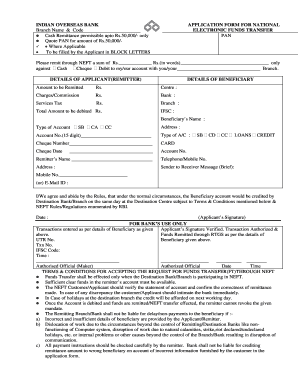

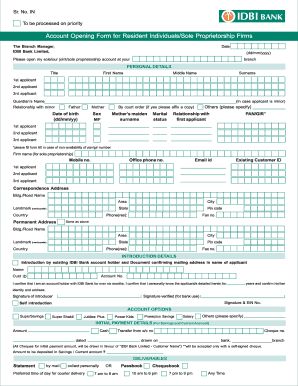

Comprehensive Guide to the India IDBI Bank Application Form

Understanding the India IDBI Bank Application Form

The India IDBI Bank application form is a crucial document used by individuals and businesses to apply for various banking services and products offered by IDBI Bank. This form is essential for initiating the application process for personal loans, business loans, and other related financial services. It ensures that applicants provide all necessary information for the bank to assess their eligibility and requirements.

Key Features of the Form

The India IDBI Bank application form includes several key features that make it user-friendly and efficient. It collects all relevant personal information, including name, address, contact details, and financial status. Additionally, the form typically contains sections for applicants to specify the type of loan or service they are seeking. Lastly, it incorporates provisions for digital signatures and electronic submissions to enhance convenience.

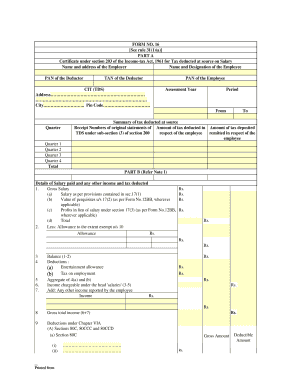

Required Documents and Information

When filling out the India IDBI Bank application form, applicants need to gather and submit several supporting documents. These may include identification proof, address verification documents, income statements, tax returns, and bank statements. It is important to ensure that all documents are accurate and up-to-date, as this will expedite the application process.

How to Accurately Fill the Application Form

Accurately completing the India IDBI Bank application form is vital for avoiding processing delays. Applicants should read all instructions carefully before starting. Each section of the form should be filled out completely and clearly. It may be helpful to review the information multiple times to ensure its accuracy, and using pdfFiller can facilitate corrections and modifications easily.

Common Errors to Avoid

While filling out the application form, several common errors can occur that may lead to rejection or delay. These include incomplete sections, inaccurate information, and failing to sign the form where necessary. Applicants should double-check all entries for typographical errors and ensure all supporting documents are attached.

Submission Methods for the Application Form

Applicants have several options for submitting the India IDBI Bank application form. Depending on the bank's current policies, forms may be submitted online through their official website, via email, or in person at a local bank branch. Each submission method may have different guidelines and processing times, so it is essential to choose the method that best suits the applicant's needs.

Eligibility Criteria for Applicants

To successfully complete the application process for IDBI Bank services, applicants must meet specific eligibility criteria. These criteria typically include age requirements, steady income verification, and a satisfactory credit rating. Understanding these criteria before applying can save time and enhance the chances of acceptance.

Frequently Asked Questions about idbi rtgs form

What types of services can I apply for using the India IDBI Bank application form?

You can apply for various services, including personal loans, business loans, and credit products through the India IDBI Bank application form.

How can I ensure my application is processed quickly?

To ensure prompt processing, complete all sections accurately, attach required documents, and choose the appropriate submission method.

pdfFiller scores top ratings on review platforms